are assisted living expenses tax deductible in 2019

Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as. Special rules when claiming the disability amount.

However it depends on what that amount includes and why an individual is in catered living.

. For information on claiming. The medical deduction for assisted living includes all the expenses if the primary reason for living in a. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters.

Yes assisted living expenses are tax-deductible. Which means a doctor or nurse with. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. In order for assisted living. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your.

In 2019 this threshold will be 10. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. June 1 2019 707 AM.

June 4 2019 148 PM. There are special rules when claiming the disability amount and attendant care as medical expenses. In order for assisted living.

If their long-term care expenses are more than 10 of your gross income as of 2019 and they are considered chronically ill these expenses are tax deductible. Yes in certain instances nursing home expenses are deductible medical expenses. Simply add up the.

Its important to note that each financial situation is. If you your spouse or your dependent is in a nursing home primarily for medical. Yes the payments are deductible under medical expenses.

In fact you may be able to deduct a portion of what you pay for assisted living costs. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. 1 Best answer.

Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction.

Chronic Illness and Tax Deductible Status. The IRS says to list deduct medical expenses on Schedule A of Form 1040 as you figure out whether your itemized deductions reduce your federal income tax more than your. Can You Write Off Assisted Living On Your Taxes.

Certain conditions that must be met to qualify. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care.

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Are Assisted Living Costs Tax Deductible

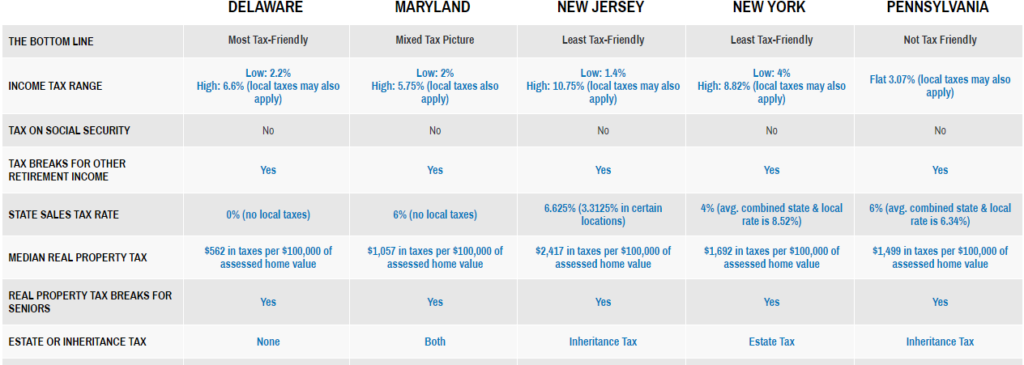

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Senior Living Tax Benefits Guide Brightview Senior Living

Federal Budget 2022 23 Cost Of Living Relief Taxbanter

How To Deduct Home Care Expenses On My Taxes

4 Tax Breaks That Reduce In Home Senior Care Expenses Care Com Homepay

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Private Home Care Services May Be Tax Deductible

10 Tax Deductions For Seniors You Might Not Know About

Common Health Medical Tax Deductions For Seniors In 2022

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia